The Total Liabilities for the formula includes all short and long-term debts except for your mortgage as shown in the formula you must subtract from the total liabilities before you divide.

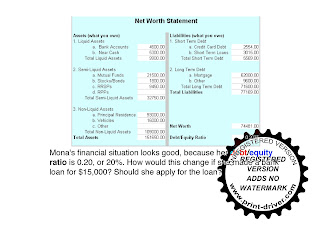

Mr. K also showed us a Net Worth spreadsheet to calculate you debt/equity ratio and Net Worth at the same time where you just type in all the types of assests and liabilities you have in there catagory.

Link: http://tinyurl.com/4x8exe

So after that we did a question on mona wanting to do some extensive house renovations. We used this spredsheet to calculate her debt/equity ratio and net worth in order to see if she was able to get the loan.

.jpg)

We find her debt/equity ratio to come up to 20% but if mona was to get a $15000 loan it would rise up to 51% which means the bank will probably not give her the loan since it is over 50%.

These are 3 tips to raise one's net worth:

1. Get higher rates of return on your investments.

2. Reduce your debts. Remember the more extra money you put on your payments you make on your debts the faster they will reduce.

3. Save more on a regular basis. Save at least 10% of your income. Save before you spend.

Next Scribe: David-san

No comments:

Post a Comment