If you’re renting these are some things that you should keep in mind:

1. You need to pay the monthly rental payments in advance plus probably one month’s rent in advance as damage deposit.

2. It is cheaper to rent a home in the short run than buying, but it doesn’t create any assets.

3. You need to know what is included in the rental payments. Example: are the utilities (especially water, hydro, heating) included? Is the home furnished…etc.

4. When renting a house, the rental payments will increase over time and you don’t create any assets. If you buy a house then the value of the house normally increases with time.

Non-financial factors to consider when renting:

1. When renting you might be restricted to your lifestyle. Example, you maybe not be able to have pets, or modify the home to suit your personal needs.

2. Repairs, maintenance, or property taxes you are not responsible for. Example, if the hot water tank needs replacing, the owner is responsible.

3. It is better to rent then buy a home if you only need the home for a short time. So then you can avoid the inconvenience and expense of reselling the home.

Now, we will look at the costs associated with buying and renting a home.

"How Much Can I Afford to Pay for a Home?"

Banks and other lending institutions have developed a formula that

allows you to calculate the maximum price of a home you can afford.

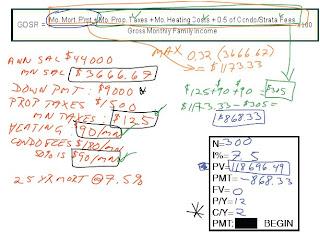

This formula is known as the Gross Debt Service Ratio, or GDSR.

According to this formula, anyone buying a home should spend no

more than 32% of gross income on household or accommodation

expenses, including mortgage payments, property taxes, heating

and condo/strata fees. The formula may be written as:

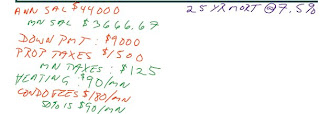

Question #1

Question #1Lucy Brown wants to buy a condo, but does not know how much money she

should spend based on her income. She earns $44 000 per year, and has saved

$9000 for a down payment. The property taxes for the condo she likes are

$1500 per year, and the heating costs average $90 per month. The condo/strata

fees are $180 per month. The bank will give her a 25-year mortgage at an

interest rate of 7.5%. What is the maximum price she can afford for a condo,

based on spending no more than 32% of her gross income on household and

accommodation expenses?

Now since there is so much stuff in the question just break it down into small parts like it is done below.

Once you have done that you can finish answering the question…..like done below.

I know that you are probably wondering why C/Y is 2. Well it is 2 because by law in Canada the bank can ONLY compound you twice a year!

After you calculated everything your Present Value will be $118,696.49 after 25 years. Plus you have to include the $9000 down payment that Lucy has saved up. (Showed below)

I know that you might be wondering what do some of these mean...right down below are some of the definitions.

1. Appraisal fees- The process through which conclusions of property value are obtained; also refers to the report that sets forth the process of estimation and conclusion of value.

2. Property survey- The process by which boundaries are measured and land areas are determined; usually performed by a land surveyor.

3. Insurance costs for high ratio mortgages- This is only for first time house buyers, you only pay 5% of it & the bank pays the rest.

4. Land transfer tax- A tax payable to the Provincial Government by the purchaser upon the transfer of title from a seller.

5. Interest adjustments- Extra proceeds going to an investor who submits a convertible bond for conversion to account for interest accrued since the last date of record for an interest payment.

6. Legal fees- A fee paid for legal service.

I hope you guys like my scribe post & I'm sorry if the pictures arent that good….but now I’m off on my choir & vocal jazz trip to moose jaw! I am honored to announce that our next scribe post will be by the one the only H20!!!!! YEAH.

No comments:

Post a Comment